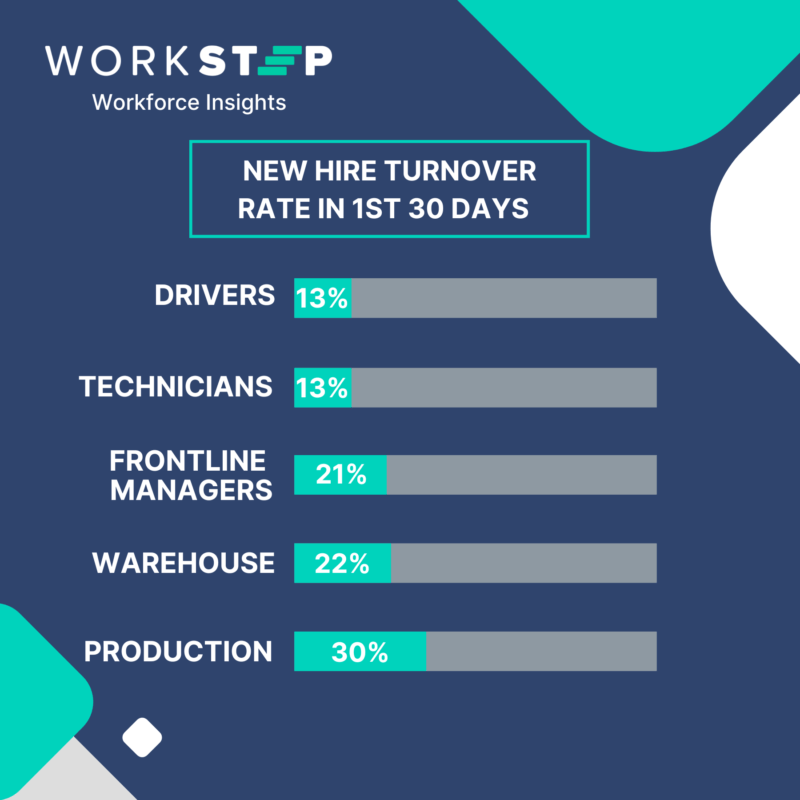

Weekly workforce insights: New hire turnover rates in first 30 days by role

September 2, 2022

Today we share benchmark employee turnover data for a few of the most popular supply chain role types. What you can see is for the most part, the more skilled roles – CDL drivers and technicians – tend to have much lower turnover.

This makes sense because these hires are much less likely to float between industry sectors or into gig jobs. Perhaps the most jarring insight here is just how high turnover is among frontline manager populations. These hires are typically two to three times more expensive to replace than an associate level role, so they are that much more critical to hire correctly and engage early.

Finally, we see that frontline production roles suffer the highest turnover of all, losing almost a third of new employees in their first month.

As a quick aside, the reason we look at new hire turnover specifically for this analysis is that overall turnover rates can skew as average workforce tenure changes. For example, a rush of new hires will pull overall turnover rates up in the short term.

Benchmarking against your peers is good for curiosity and peace of mind. Where it can be most actionable, however, is investing attention in those role types that fall most short of benchmark and learning from those areas where you and your team are well ahead of your peers.

Tune into your frontline with WorkStep

With the frontline employee engagement platform that delivers the real-time insights you need to take action, retain your workforce, and drive your business forward.

Dan Johnston, Co-Founder & CEO | dan@workstep.com